What is Digitalisation?

Digitalisation refers to the integration of digital technologies into our everyday lives.

Much of what we do, where we go, what we say, where we say it can be captured online or tracked by smart devices that record us in the form of data. This data is stored in binary code to facilitate computer processing. It is what this data reveals about us that makes it such a highly valuable asset. It can reveal our personal preferences even our character and our personality.

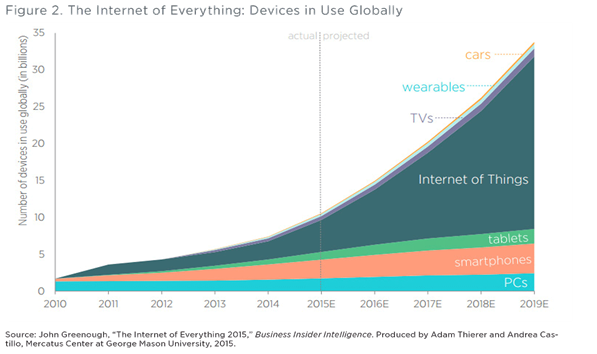

The fact that “data” can reveal certain underlying truths about us is no surprise. What has changed is the volume of data available, specifically unstructured data, that has been generated from our digital interactions. It has been estimated that every day we generate 2.5 quintillion bytes of data — so much that 90% of the data ever generated on the planet has been created in the last two years alone[1]. With the onset of greater connectivity (the Internet of Things) the amount of data we produce is increasing to levels never experienced before.

Digital Transformation of Banking

One industry that has been transformed by digitalisation is banking. Digital technology has transformed financial services disrupting the competitive landscape for traditional market providers. This has enabled new and powerful players from outside the banking industry to enter and offer customers more innovative and convenient ways to manage their finances.

Revenue generating functions within a banks’ business model are now being offered by Fintech companies at much lower rates. They are eager to take advantage of the slow reaction of large financial institutions to their emergent technologies.

The graphic above reveals the emergent Fintech Ecosystem, where major operational functions within a bank are being successfully offered by new technology companies. From payments, to lending, to financial management, to compliance there is no service within financial services that cannot be disrupted and improved by new technologies.

A (Brief) History of Banking

Up to 1980 the original banking model evolved around a fixed location that held money and other valuable items on site in a vault. The content of that vault was backed by a precious metal, often gold. To “do” banking you had to be in a bank. This represented a single channel of banking or the Mono-Channel.

From 1980 to 2000 the number of channels open to customers to engage with their bank increased. In addition to the fixed, physical bank, the ATM allowed banking outside of specific hours, telephone banking accommodated self-guided services and online banking allowed customers to manage their financial affairs at a time of their choosing. This was the start of the digitalisation process.

These changes represented a paradigm shift towards a Multi-Channelled approach to banking. There were multiple ways people could engage with their bank to conduct their financial affairs. However, this multi-channel approach was not always fully integrated. You may have telephone banking but you could not make certain payments; you may have online banking but you could not open an account as this requires a signature. Each new channel was limited in what it could offer, often needing another channel to fully complete a task.

The Omnichannel

Today we have seen the emergence of the ”Omni[4]-Channel Paradigm”: banking services fit together in a seamless way. There is no need to “hand-off” to another function because the function you are in can now completely fulfill the service you want. These different channels of service fit together to create a holistic experience for the customer.

There are a number of UK based Fintech companies that can offer their client banks this Omni-Channel experience. Their technology can integrate with the main core systems of their banking clients. Such Fintech companies believe that banks need to offer Omni-channel platforms to remain customer focused. After all customers sit on allot of money!

An analysis of the product range offered by one such UK based Fintech company reveals what an Omni-channel banking platform looks like:

1) Mobile Banking Solutions

Users can add contacts from their social media networks to conduct transactions with them. This turns social media platforms into financial transaction opportunities.

2) Augmented Reality

Customers simply point their smart phone at a piece of marketing material for a particular banking product (e.g. an investment product or a mortgage). Data is pulled from both their phone and the marketing document to indicate the suitability of the product and its potential benefits to the customer as an investor.

3) Beacons

When a customer walks near a bank branch they may receive notifications on their mobile phone of a particular product they have invested in and its performance. This can be a self-selected, proactive notification and can be managed by the customer.

4) Digital Product Subscription

Using a “Tablet” customers can undertake any operation online that was previous only possible in a bank branch. For example, an account can be opened by digitalising all the required documentation. Contracts are generated with all the relevant sections completed which can be confirmed with an electronic signature.

5) Wearables

Applications for the smart watch allow customers to check their transaction history, their bank balance, make payments and undertake transactions.

6)Voice Banking

Using voice recognition software, customers can speak into their phone and give instructions in the same way you can with Siri (Apple phone). Customers can ask for their balance, undertaken transactions, enquire about financial products and make payments.

At each stage of the Onmichannel experience huge amounts of data are generated. This data is fed back to the banks who can analyse it to refine their investments and customer experience. Whether the banks own the technology behind these services is for another article. Certainly the digitalisation of banking has had a huge effect on the banking industry. The question remains: is there a need for central banking at all?

-oOo-

[1] Www-01.ibm.com. (2016). IBM – What is big data?. [online] Available at: http://www-01.ibm.com/software/data/bigdata/what-is-big-data.html [Accessed 3 Jun. 2016]

[2] Greenough, J. (2015) THE INTERNET OF EVERYTHING: 2015 [SLIDE DECK]. Available at: http://uk.businessinsider.com/internet-of-everything-2015-bi-2014-12?r=US&IR=T (Accessed: 6 June 2016).

[3] Intelligence (2016) The fintech industry explained: The trends disrupting the world of financial technology. Available at: http://www.businessinsider.com/fintech-ecosystem-financial-technology-report-and-data-2016-2?IR=T (Accessed: 6 June 2016).

[4] Meaning “all; of all things” from www.dictionary.com/browse/omni-of banking has had a huge effect on the banking industry. The question remains: is there a need for central banking at all?